Accounting for marketing agencies: budgeting, KPIs and freeing up time for creativity

We invest in deep research to help our audience make better software purchasing decisions. We’ve tested more than 2,000 tools for different finance and accounting use cases and written over 1,000 comprehensive software reviews. If you’re looking for an effective platform for managing your agency financials and other key operations, consider Productive. It’s designed to be the all-in-one solution to support agency workflows.Book a demo today to learn more. A large cash balance can lull an agency owner into making taxpayer identification number tin less disciplined choices, like tolerating decreasing margins or even negative cash flow months when business slows down.

Can the software help with compliance and regulatory reporting specific to the advertising industry?

Adding your agency’s client list in the accounting software allows you to populate invoices with client information, such as email and physical addresses, point of contact information, notes, etc. Integrations can simplify your agency’s accounting when the alternative is to manually import data into your accounting software. Accounting software also has a bank reconciliation feature that, when used on a regular basis, keeps account balances in the accounting software in sync with actual bank account balances. To benefit from project-based accounting, your agency should first implement best practices specific to agencies.

Strategies for Effective Cash Management

Payment terms are the expectations of how and when a client will pay once you invoice them. Your contracts and invoices should establish clear payment terms and create a sense of urgency around payment. An agency’s “receivables” balance represents amounts invoiced but not yet collected from customers.

best practices for marketing and advertising agency financial reporting

By considering your expenses through the lens of your profit, the idea is to reduce your spending according to the volume of sales. Don’t sleep on implementing Profit First or choosing the right accounting services – they could nonprofit bylaws best practices be game-changers for your agency’s bottom line. Managing accounting internally allows for real-time oversight and control but may require extensive time and resources.

- If revenues are lower than anticipated, you might need to consider cutting costs to avoid burning through cash reserves.

- To perform advanced accounting tasks such as preparing budgets and cash flow forecasts you’ll need to use the accrual method.

- Integrations can simplify your agency’s accounting when the alternative is to manually import data into your accounting software.

- It can easily consume most of your day preparing the reports, checking data accuracy, and even ensuring the reports you create are being read and responded to.

- This empowers them to make well-informed decisions based on up-to-date information regarding their finances.

- Fiskl is an accounting software tailored for creative and marketing agencies, offering strong mobile invoicing and multi-currency support.

It helps in tracking the money coming in and going out, providing insights into the company’s liquidity. Efficiently organizing monthly bookkeeping tasks involves setting up clear processes supported by reliable accounting systems or software solutions tailored specifically for small businesses like marketing agencies. Inaccurate financial records may lead to incorrect tax filings, resulting in fines or audits by tax authorities. Moreover, misleading data can hinder the ability to make informed business decisions, potentially impacting the agency’s growth and profitability. Different strategies, such as incremental budgeting or zero-based budgeting, are suitable for marketing agencies.

Large companies often use enterprise-level solutions like SAP S/4HANA, Oracle Financials Cloud, or NetSuite. However, for advertising agencies, popular choices include QuickBooks, Xero, and FreshBooks, as mentioned in our comparison. Coefficient works seamlessly with these platforms, allowing agencies to create custom reports and dashboards using their accounting data.

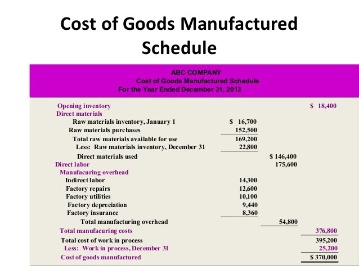

An agency recognizes deferred revenues when a client pays in advance for services not yet rendered. Examples of deferred revenues include pro-forma, upfront, and retainer payments. Tracking your agency’s WIP balances can prevent cash flow and capacity issues, since WIP represents labor costs incurred but not yet recouped.

If there’s any kind of subscription or retainer strand to your marketing business, you’ll have a slight advantage – a reliable revenue stream provides a useful safety net if there’s a gap between projects. Most agencies don’t have that luxury, though, and those I work with tell me they’re often either too busy to cope, or anxiously chasing contracts. But the rewards—financial clarity, better information for decision-making, improved profitability—are well worth the effort. If the prospect of building an accounting system for your agency seems daunting, start small and make improvements as you go. The the role and responsibilities of the managerial accountant benefit of posting adjustments is that the financial statements more accurately reflect the activities of the current period. By not recording WIP and accrued expenses, the following period might look particularly good even though most of the revenues were earned in the current period.